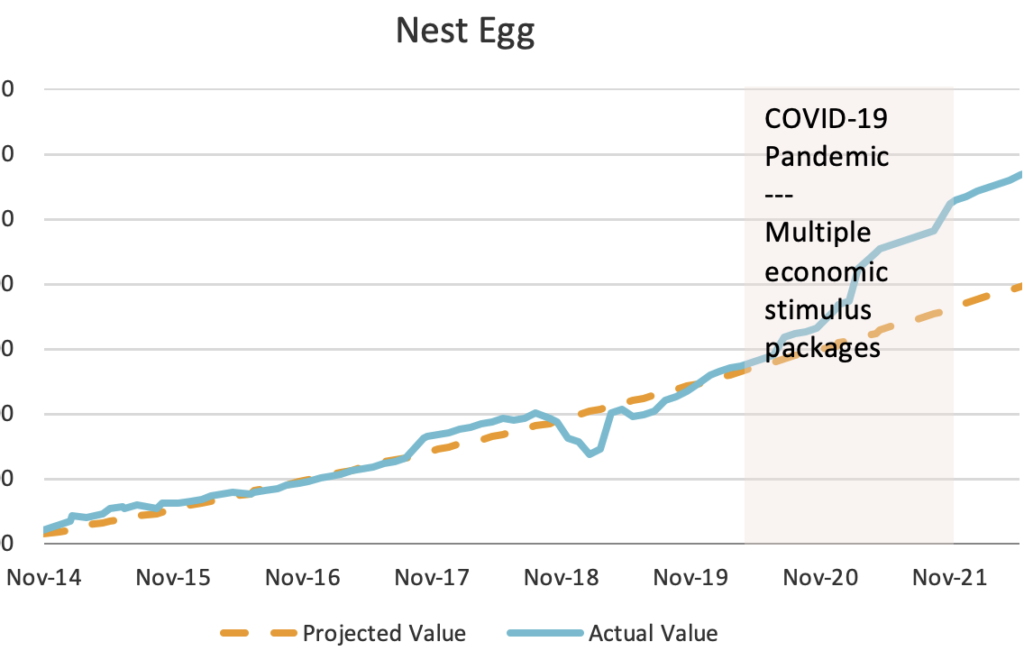

I have a spreadsheet that I’ve been updating monthly for the past 7.5 years. It tracks my monthly progress to retirement across a few meaningful metrics.

As a 20-something who graduated at the bottom of the Great Recession and struggled to find an “equitable” salary for my degree, I’ve always had a nagging fear of being able to support myself (and now pets and husband) if I ever lost my income. I lived frugally for those first few years keeping a much-too-large emergency fund before finally developing my first early retirement strategy: dividend income. My spreadsheet logs the growth in the monthly dividends our household receives across our various investment and retirement accounts. I theorized that $30,000 annually in dividends should be enough to sustain a simple lifestyle to perpetuity. Dividend tracking is fun and encouraged us to continue investing in the growing stock market.

However, dividend growth of late has been difficult. 7.5 years into tracking and we’re only ~25% to goal, so we’ve needed to embrace additional strategies.

My husband and I know that the stock market offers the best return on investment, but a few years ago, we got an itch to enter real estate to “increase happiness” and diversify our investments. Also consider that a paid-off house is the only way we anticipate expenses as low as $30k/yr. Today though, I have mixed feelings about our approach. We now have 36 months of data to show that buying a house where we live (even in the gangbuster real estate market of 2021) has significantly slowed down our progress to our early retirement goal. With luck, I’m hoping another 36 months of home ownership and investment tracking will prove me wrong.

So where do we stand on our goal? The most difficult future expense to estimate is healthcare costs, though I do have some backup plans in mind. (Plan A: Health Savings Accounts, Plan B: geographic arbitrage) We’ve also accelerated our charitable giving into a Donor Advised Fund (DAF) so that we can continue gifting well into retirement, but this too is slowing our path to early retirement. But if our spreadsheet is still accurate… we believe our early retirement date will occur within 3-5 years, which means we’ll both have the option to retire by age 40.

I’m curious: do you have a retirement strategy? What are the avenues you’re exploring?

Leave a Reply